In the continuous and often superficial political discourse that pervades capitalist and liberal democracies, the topic of privatization frequently arises. Parties may argue over certain economic strategies, such as the privatization of public assets, taxation, and lending rates, yet there is a prevailing agreement that does not challenge the fundamental nature of money. Monetary policy is a cornerstone of many politicians' agendas. Those who advocate for the control of currency to be in the public's hands often face severe consequences, as evidenced by historical figures like John F. Kennedy and Gough Whitlam, who were either assassinated or forcefully removed from power. Those in power rarely confront the profound societal influence of money when addressing societal problems such as poverty, inequality, or reduced public spending.

The prevailing financial system in liberal democracies is built upon debt-based fiat money. Western consensus holds that money should be fiat, backed only by the government's promise, and controlled by an elite group of private bankers. This control over a nation's economy, as Mayer Amschel Rothschild implied, is more influential than creating its laws. Despite electoral democracy, the true control lies with the bankers, as both the politicians and the populace are subject to the financial system defined by these interests. Institutions like the Federal Reserve in the U.S. or the Bank of England, regardless of their public status, are influenced by private banking families like the Rothschilds, who dominate global economic policy, maintaining a system that enriches them while exploiting global populations.

The notion of "debt-based" currency raises concerns among those who understand it. A large portion of Americans, for instance, have scant knowledge of how the Federal Reserve functions, with surveys indicating that a vast majority lack a basic understanding of the financial system—a status quo preferred by the financial elite. Any rational individual concerned with their welfare, their children's future, and the vitality of their nation would question the wisdom of being ensnared in a cycle of interest, loans, and debts to private financiers. People naturally question the rationale behind the pairing of 'debt' with 'currency'—words that, when combined, suggest wealth creation, yet in practice denote something quite different.

The debt-based fiat currency system is essentially a state-sanctioned, privatized debt loop, which has had dire consequences. It is implicated in all wars involving the United States over the last century and is at the heart of escalating levels of enslavement, social injustice, moral decline, political corruption, and poverty worldwide. Understanding the system is straightforward. The central bank in any modern liberal democracy is a hybrid private-public institution. The Federal Reserve in the United States, despite its official sounding name, operates independently from the federal government as its recent legal defense against a Freedom of Information Act request from Bloomberg revealed. Central banks like the Federal Reserve act as sovereign financial authorities within their nations. As observed during a significant economic downturn, there seems to be an unspoken agreement: The central bank manages the economy, Congress allocates resources, and the public remains largely disengaged.

In the U.S., currency such as the United States Note, which was once backed by gold reserves, ceased issuance long ago. Following the abandonment of the gold standard under President Nixon in 1971, the country moved to a full fiat system, where currency value is determined by federal law without tangible backing. The process of money creation involves the government deciding to increase the money supply. It does so by issuing treasury bonds to the central bank in exchange for currency. These bonds are essentially promises of repayment, and the central bank issues the currency with an added interest. This system traps the government in a perpetual cycle of debt, as it can only obtain the necessary funds to pay interest by incurring more debt from the central bank, which again charges interest. Even extreme taxation could not settle this debt, as the interest owed can only be covered by yet more money creation by the central bank. This symbiotic relationship between debt and currency lies at the core of what is termed 'debt-based fiat currency'.

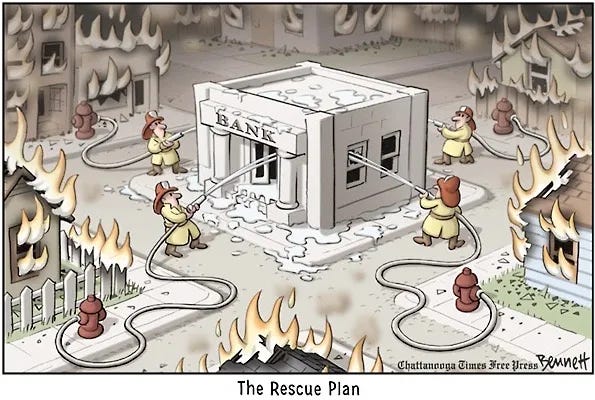

Lampooning the capitalist efforts at economic revival

Identifying the core issue with our prevailing economic framework, we now turn to outline the foundational elements of an alternative approach – a labor-based currency system. This concept draws heavily from the ideas and literary contributions of Gottfried Feder, who offered insights on this subject:

“Unfortunately the world-bankers have a damned good appetite and securities are indeed their favorite food, which obviously suits excellently. We cannot count on them going hungry, like King Midas, for whom, as is well-known, even the food in his mouth turned to gold. On the contrary, the workers will first go hungry before the interest lords will.”

— Gottfried Feder, Manifesto For The Abolition of Interest Slavery

In a system where currency issuance is predicated on labor value, the growth of the monetary base is intrinsically connected to governmental investments in public infrastructure and essential services. These include enhancements in societal services like mass transit systems and emergency management, as well as foundational projects such as the development of roads and energy facilities. In such an economy, all banking operations, both at the central and retail levels, are administered by the government in a non-profit capacity, safeguarding citizens' fiscal interests, offering loans free of interest, and managing the circulation of money.

The government is responsible for assessing the expenditures of state-led initiatives, setting the worth of the labor and materials needed, leading to a standardization of prices across the economy. The value of the currency is thus pegged to the nation's ability to deploy its human and material capital in the construction and upkeep of vital infrastructure and services. During economic recessions, the state assumes the role of the ultimate employer, generating employment opportunities that uphold the self-respect of its jobless citizens. Compensation for such state-sponsored work or for materials sourced from the private sector is dispensed through government-guaranteed vouchers, redeemable at state banks. This mechanism ensures that the circulation of money in the private sector is contingent upon prior public sector outlay, and if the private sector fails to generate sufficient jobs, the government steps in, favoring communal welfare over individual profit.

The government further exercises control over the private sector by fostering the proliferation of businesses that manufacture indispensable goods and services and by limiting excess in industries oversaturated with non-essential products. This regulatory function is designed to avert market distortions and guarantee the accessibility of necessary goods. With the adoption of a labor-valued currency framework, conventional taxation, including income and corporate taxes, becomes redundant since the state itself generates the funds required for its functions and exercises control over the extent and nature of private production.

In this framework, the government steers the economic direction, answerable to the citizenry, while maintaining dominance over essential services to prevent the private sector from diminishing governmental influence. Vital public services such as power, communication networks, public transit, and health services remain under public jurisdiction, ensuring the government's commitment to the common good. For international commerce, particularly for nations that are deficient in specific resources or commodities, trade is structured around the reciprocal exchange of essential goods and resources, directly negotiated between the nations involved, bypassing the need for a global intermediary. This strategy is intended to lessen exploitation and certifies that the exchange of labor across borders is prohibited, thus protecting local workforces from being undercut by less expensive foreign labor.

In a system where the government is responsible for the creation of money, the currency's value is intrinsically linked to the nation's ability to employ its citizens in the service of state development and maintenance. Such a currency escapes the clutches of international financial powers that often deem one nation's currency less valuable than another's—whether due to smaller gold reserves or arbitrary declarations by influential entities favoring a regime of fluctuating exchange rates. This situation underscores the fallibility of both historically metal-backed and currently debt-backed currencies within Western economies, highlighting the self-serving nature of global banking entities and their corporate allies. These financial institutions have a history of manipulating economies, effectively holding populations at their mercy in a skewed contest for worldwide resource acquisition.

Addressing this matter swiftly and laying the foundation for a labor-centric economy can be succinctly outlined:

Nationalization of the Federal Reserve and Lending Institutions: This would involve the U.S. government taking ownership of the Federal Reserve (the U.S. central bank) and possibly other financial institutions that profit from interest-based lending. The goal would be to ensure that the creation and lending of money serve public interest rather than private profit.

Public Financing of Infrastructure Projects: In the U.S., this would mean funding significant public projects, such as renewable energy development or transportation infrastructure, through the issuance of non-interest bearing government bonds, or by direct government spending, rather than through loans that accrue interest and add to public debt.

Stable Currency Backed by Tangible Assets: The introduction of a fixed standard of currency would involve tying the value of the U.S. dollar to a secure and tangible asset or a basket of assets, potentially to stabilize the currency and prevent inflation.

Establishment of a National Development Bank: The creation of a government-backed development bank in the U.S. could provide loans without interest for business development and innovation, stimulating economic growth and reducing the cost of financing for new and expanding businesses.

Wealth Redistribution and Fair Taxation: Implement a transformative wealth and income tax strategies, eliminating regressive indirect taxation, revising inheritance tax laws, and instituting both minimum and maximum income limits to equitably redistribute wealth, diminish economic disparities, and guarantee a basic standard of living for all citizens.

Redefining Economic Equality and Stability: The "National Labor and State Assembly" (NLSA) would serve as the central legislative authority, supplanting the traditional two-chambered Congress, with a focused role in orchestrating negotiations and policy-making between labor representatives and state officials, while deliberately excluding direct corporate engagement. Tasked with advocating for reforms that tackle wealth disparities and bolster financial security across the workforce, the NLSA would undertake the evaluation and potential overhaul of tax systems to enhance their progressiveness, set thresholds for minimum and maximum earnings, and investigate strategies for redistributing wealth to bridge the economic divide, ensuring that all individuals can maintain a decent standard of living. In essence, it would oversee all dimensions and every profession or job connected to the workforce.

Implementing these ideas in the United States would require extensive governmental changes and a shift in the philosophical approach to monetary policy, banking regulation, and fiscal policy. It would be a fundamental transformation of the financial system, likely to encounter significant resistance from various stakeholders who have vested interests in the current capitalist system.